Amendments to the Communiqué on Procedures and Principles Regarding the Fees that Banks Can Charge Their Commercial Clients

The procedures and principles regarding the fees that banks can charge to their commercial clients have been amended by the Communiqué (No: 2025/24) (the “Communiqué”), which was published in the Official Gazette dated 18.09.2025 and numbered 32568. This Communiqué amends the Communiqué on the Procedures and Principles Regarding Fees that Banks Can Charge Commercial Clients (No: 2020/4).

The Communiqué, which will come into effect on 01.11.2025, lays down new provisions regarding arrangement fees and utilization fees that banks classify under two distinct sub-categories and that may be charged by the banks to their commercial clients. Moreover, the Communiqué introduces certain amendments with respect to merchant fees that businesses must pay when they accept electronic payment methods, such as credit cards or debit cards:

Arrangement Fee and Utilization Fee

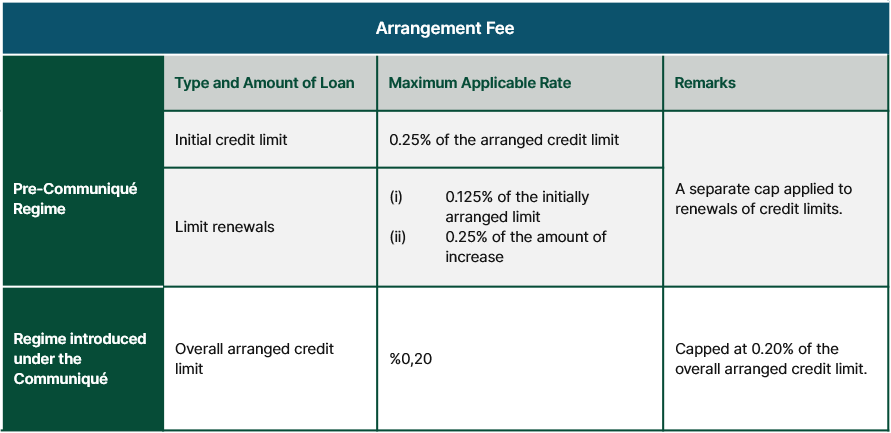

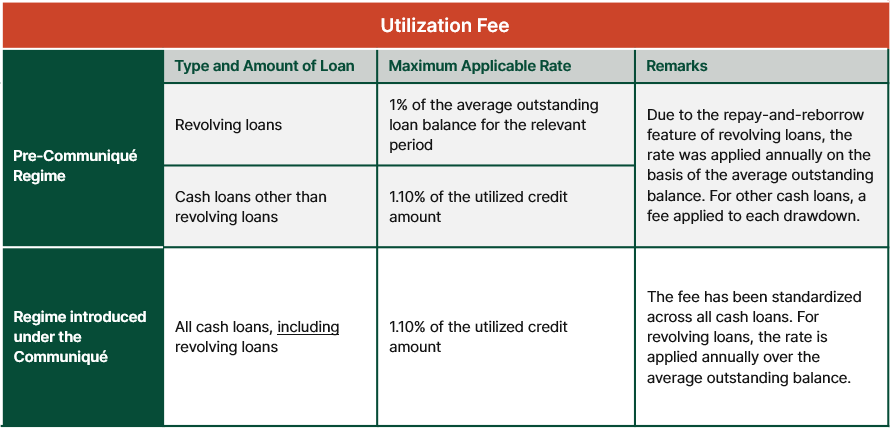

The Arrangement Fee is the fee payable by the borrower to the arranger on signing the loan agreement, usually calculated as a percentage of the amount of the loan that was made available (cash and non-cash) to the borrower. The Utilization Fee is a banking fee generally levied in respect of the utilization of credit limits and is calculated on a percentage basis over the cash amount disbursed under the credit limit. The maximum rates applicable to such fees are stipulated separately in the legislation for consumers and for commercial clients.

The provisions governing the arrangement and utilization fees that banks may charge to their commercial clients were first introduced in 2020, and, under the regulation enacted at that time, the maximum arrangement fee rate was set at five per thousand (0.5%) of the allocated credit limit. During the 2020–2025 period, this cap was reduced gradually and, under the Communiqué, was lowered to 0.20%. Utilization fees have been varying between 1 and 1.10% over the years, and the Communiqué has just standardized the rate to 1.10% for all cash loans. This last development has resulted in a contraction in banks’ fee income derived from arrangement fees, whilst constituting a more favorable arrangement, lowering borrowing costs, for borrowers.

Merchant fees

Under the Communiqué, the existing provision on non-instalment purchases of goods and services has been confined to credit-card transactions; moreover, a maximum merchant fee of 1.04% has been set for purchases made by debit card. It is further stipulated that the regulatory rules and limitations applicable to debit-card transactions shall likewise apply to prepaid cards.

All rights of this article are reserved. This article may not be used, reproduced, copied, published, distributed, or otherwise disseminated without quotation or Erdem & Erdem Law Firm's written consent. Any content created without citing the resource or Erdem & Erdem Law Firm’s written consent is regularly tracked, and legal action will be taken in case of violation.

Other Contents

Two Communiqués published in the Official Gazette dated 31.01.2026 and numbered 33154 introduced amendments to certain regulations in the financial services sector…

The Constitutional Court’s (Constitutional Court) decision dated 15.10.2025 and numbered 2024/193 E. and 2025/136 K. (Decision) was published in the Official Gazette dated 15.10.2025 and numbered 33048. The Constitutional Court annulled Article 1, as well as Article 2 and Additional Article 5 (which were deemed...

The Capital Markets Board (CMB) published the Decision numbered i-SPK.35/B.2 (Decision No. 30/846) (Decision) through the Capital Markets Board Bulletin dated 08.05.2025...

The Presidential Decision Amending Decision No. 32 on the Protection of the Value of the Turkish Currency (Amendment) was announced in the Official Gazette dated 15.03.2025 and numbered 32842...

The Communiqué No. 2025-32/72 on Amendments to the Communiqué No. 2008-32/34 Regarding the Protection of the Value of the Turkish Currency (Amending Communiqué) was published in the Official Gazette dated 06.03.2025 and numbered 32833...

The Banking Regulation and Supervision Agency's (the BRSA) Decision (Decision) dated 06.02.2025 and numbered 11145 was published. With the Decision, BRSA Decisions dated 24.06.2022 and numbered 10250, dated 07.07.2022 and numbered 10265, dated 28.09.2022 numbered 10348, dated 21.10.2022...

The Communiqué on Redetermination of Minimum Equity Amounts of Payment and Electronic Money Institutions (Communiqué) is published in the Official Gazette dated 30.01.2025 and numbered 32798. The Communiqué enters into force on 30.06.2025 and amends the minimum equity amounts stipulated...

The Communiqué (Communiqué No: 2024-32/70) Amending the Communiqué (Communiqué No: 2008-32/34) on the Decree No: 32 regarding the Protection of the Value of the Turkish Currency was published in the Official Gazette dated 08.10.2024 and numbered 32686...

The Communiqué (No: 2024/2) Amending the Communiqué on Reserve Requirements (No: 2013/15) (Communiqué) has been published in the Official Gazette dated 30.01.2024 and numbered 32445. The Communiqué entered into force on the date of its publication, effective from 19.01.2024. The amendments made...

The Communiqué (No: 2024/1) Amending the Communiqué (No: 2010/2) on the Printing Method of Checkbooks and Determination of the Amount that Banks are Obliged to Pay to the Bearer (Communiqué) was published in the Official Gazette dated 27.01.2024 and numbered 32442. The Communiqué enters...

The Communiqué on Redetermination of Minimum Equity Amounts for Payment and Electronic Money Institutions (Communiqué) has been published in the Official Gazette dated 27.01.2024 and numbered 32442. The Communiqué enters into force on 30.06.2024 and amends the minimum equity amounts...

The Regulation on Loan Operations of Banks (Loan Operations Regulation) and the Regulation on Determination of Risk Groups and Credit Limits (Risk Groups Regulation) (together Regulations) are published in the Official Gazette dated 21.12.2023 and numbered 32406. The Regulations will mostly enter into force...

The Central Bank of the Republic of Türkiye's (CBRT) communiqués (Communiqués) introducing new regulations on Foreign Exchange Protected Deposit (FXPD) accounts have been published in the Official Gazette dated 20.08.2023 and numbered 32285. The regulations therein aim to minimize the volume of the...

The Communiqué (No. 2023/16) on the Amendment to the Communiqué on Required Reserves (No. 2013/15) (Communiqué) is published in the Official Gazette dated 08.07.2023 and numbered 32242. The Communiqué entered into force on the date of its publication, effective as of 07.07.2023. With the Communiqué...

The Communiqué Amending the Communiqué on Securities Maintenance (Amending Communiqué) is published in the Official Gazette dated 25.06.2023 and numbered 32232. Significant amendments introduced by the Amending Communiqué are...

The Regulation (Amending Regulation) Amending the Regulation on Payment Services and Electronic Money Issuance and Payment Service Providers (Regulation) and the Communiqué on Information Systems of Payment and Electronic Money Institutions and Data Sharing Services of Payment Service...

The Regulation Amending the Regulation on Remote Identification Methods to be Used by Banks and Establishment of Contractual Relations in Electronic Environment (Regulation) is published in the Official Gazette dated 25.05.2023 and numbered 32201. The Regulation will enter into force on 01.06.2023...

The Communiqué Amending the Communiqué on Securities Maintenance (No: 2023/11) (Amendment) entered into force through publication in the Official Gazette dated 17.05.2023 and numbered 32193. With the Amendment, a temporary practice regarding banks’ securities maintenance obligation has been...

The Regulation (Amending Regulation) Amending the Regulation on Payment Services and Electronic Money Issuance and Payment Service Providers (Regulation) and the Communiqué on Information Systems of Payment and Electronic Money Institutions and Data Sharing Services of Payment Service...

The Communiqué on Redetermination of Minimum Equity Amounts for Payment and Electronic Money Institutions (Communiqué) is published in the Official Gazette dated 28.01.2023 and numbered 32087. The Communiqué will enter into force on 30.06.2023. As per the Communiqué, the minimum equity amounts...

The Regulation (Amending Regulation) Amending the Regulation on Payment Services and Electronic Money Issuance and Payment Service Providers (Regulation) and the Communiqué on Information Systems of Payment and Electronic Money Institutions and Data Sharing Services of Payment Service...

On 28.10.2022, Banking Regulation and Supervision Agency published the Draft Regulation Amending the Regulation on Debit Cards and Credit Cards (Draft Regulation) on its website to receive market players’ comments...

The Communiqué Amending the Communiqué on Maintenance of Turkish Lira-Denominated Securities for Foreign Currency Liabilities and the Communiqué Amending the Communiqué on Required Reserves (together referred to as “Amendment Communiqués”) were published...

On 11.08.2022 The Circular No. 2022/1 Explaining the Application of The Regulation for Disclosure of Confidential Information (The Circular) has been published by the Banking Regulation and Supervision Agency (BRSA). The Circular was published in order to shed light on the...

Law No. 7407 on Amendments to the Banking Law, Certain Laws and Decree Law No. 655 ("Law") published in the Official Gazette dated 28.05.2022 and numbered 31849 introduced various amendments to the banking legislation. The amendments are briefly summarized...

Following the publication of The Communiqué No. 2022-32/66 Amending the Communiqué No. 2008-32/34 (“Communiqué No. 2008-32/34”) regarding the Decree No:32 on Protection of the Value of Turkish Currency (“Communiqué No. 2022-32/66”) in the Official Gazette...

The Communiqué No. 2022-32/66 Amending the Communiqué No. 2008-32/34 (“Communiqué”) regarding the Decree No:32 on Protection of the Value of Turkish Currency was published in the Official Gazette dated 19 April 2022 and No. 31814...

The Communiqué (III-42.1) on Remote Identification Methods to be Used by Intermediary Institutions and Portfolio Management Companies and...

Following the publication of the Official Gazette dated 04.02.2022 and numbered 31740, the Banking Regulatory and Supervisory Authority (“BRSA”) made amendments regarding the banking sector which...

Pursuant to the Communiqué on the Re-determination of Minimum Equity Amounts of Payment and Electronic Money Institutions (“Communiqué”) which is published in the Official Gazette dated 22.01.2022 and numbered...

TR QR Code Period in Payment Services is Commencing

The Regulation on the Amendment to the Regulation on Bank Cards and Credit Cards is published

Announcement of the Banking Regulation and Supervision Agency dated 08.12.2020

Amendment to the Regulation on Procedures and Principles concerning Monitoring of Transactions Affecting Foreign Exchange Position by Central Bank of Republic of Turkey

Amendment to the Communiqué on the Procedures and Principles Regarding the Fees that Banks Can Charge Their Commercial Clients

The Regulation on Prevention Plans to be Prepared by Systemically Important Banks is published

The Period of the Low Withholding Rates Related to Deposit Interest and Dividends Paid by Participation Banks are Extended

Regulation on Remote Identification Methods to be Used by Banks and Establishment of Contractual Relations in Electronic Environment is Published

Regulation on Not Using Crypto Assets in Payments is published

General Communiqué of the Financial Crimes Investigation Board is Published

Amendment to the Regulation on Measures Regarding Prevention of Laundering Proceeds of Crime and Financing of Terrorism

Communiqué on Portfolio Management Companies was Amended

The Implementation of Credit Rating is Postponed to December 31st

The Period of the Application of Low Withholding Rates on Deposit Interest and Dividends Paid by Participation Banks are Extended

The Regulation on Sharing of Confidential Information was Published

RUSF Rate for the Loans Obtained from EBRD and IFC

Amendment to the Regulation on the Procedures and Principles Regarding the Classification of Loans and Provisions to be Set Aside for Them

Amendment to the Regulation on Loan Operations of Banks

The Period of the Application of Low Withholding Rates on Deposit Interest and Dividends Paid by Participation Banks are Extended

The Withholding Rate on Earnings from Shares of Venture Capital Investment Fund and Real Estate Investment Fund Participation Shares Held for More than Two Years Has Been Reduced to 0%

The Period of the Application of Low Withholding Rates on Deposit Interest and Dividends Paid by Participation Banks are Extended

The Communiqué on the Amendment to the Communiqué on Mandatory Reserves is published