European Courts’ Diverging Approach over Intra-EU Investment Arbitrations

Introduction

In the aftermath of the Achmea decision[1], controversies on intra-EU arbitrations continue. Most recently, the Paris Court of Appeal has annulled two arbitral awards rendered against Poland. Meanwhile, the Higher Regional Court of Berlin has refused to declare that an Irish investor’s ICSID claim against Germany is inadmissible.

The Background

In the Achmea dated 06.03.2018, the Court of Justice of the European Union (“CJEU”) ruled on the incompatibility of intra-EU arbitrations with European Union (“EU”) law. According to the CJEU, the Netherlands-Slovakia bilateral investment treaty was contrary to the primacy and uniform application of EU law. Following this decision, the jurisdiction of arbitral tribunals dealing with intra-EU disputes came to a halt.[2]

A number of arbitral tribunals such as Vattenfall AB and others[3], UP (formerly Le Chèque Déjeuner) and C.D Holding Internationale[4] and Masdar Solar & Wind Cooperatief[5] refused to apply the CJEU’s reasoning in Achmea and upheld their jurisdiction. Their main justification for doing so was the non-applicability of the Achmea judgment to multilateral treaties such as the Energy Charter Treaty (“ECT”). However, the Komstroy[6] ruling of the CJEU followed the reasoning of the Achmea to invalidate referrals to arbitration for investment disputes between member states governed by ECT.[7]

Annulment Decisions from French Court

The applicability of Achmea to arbitral proceedings has been raised as an annulment ground in some recent cases. Poland sought annulment of arbitral awards rendered against Poland and in favour of (i) Austrian investors “Strabag and Raffeisen Centrobank” and (ii) a Czech investor “Slot Group”. The Strabag case was filed under the Austria – Poland BIT in 2014, and governed under ICSID Rules. The claimants’ alleged infringement related to their foreign investment in Warsaw hotels. The partial award rendered by the arbitral tribunal upholding its jurisdiction was brought before the Paris Court of Appeal by Poland. The French court concluded that the arbitral tribunal wrongly upheld its jurisdiction in an intra-EU arbitration by contrasting Achmea, and set aside the partial award.[8]

The Slot Group case was filed under the Czech Republic – Poland BIT in 2016, and governed under ECT. The claim concerned gambling investors’ rights allegedly infringed after some regulatory changes in Poland. As in Strabag, the final award rendered by the arbitral tribunal upholding its jurisdiction was brought before the Paris Court of Appeal by Poland. The French court not only annulled the arbitral award by relying on Achmea, but also underlined that respondent states in intra-EU disputes are “obliged” to contest investment claims filed against them before arbitral tribunals and courts.[9]

These cases are noteworthy since they are the first examples where a state court has relied on Achmea to annul international arbitral awards while confirming its general applicability to intra-EU disputes.

Rejection of Inadmissibility by German Court

The European courts are not fully convinced of Achmea’s applicability to “any intra-EU dispute”. An Irish wind power investor called Mainstream Renewable Power and its affiliates brought an ECT claim against Germany under the ICSID Rules.[10] The claim was related to alleged disruption of offshore wind projects due to regulatory changes in Germany’s renewable energy legislation. Germany initially requested the arbitral tribunal to dismiss the case as per Achmea and Komstroy, underlining the incompatibility of intra-EU disputes with EU law. This request was rejected by the arbitral tribunal.[11]

Germany also asked the Berlin court to declare the inadmissibility of the ECT arbitration due to its intra-EU nature. The Higher Regional Court of Berlin has recently rendered a decision declining Germany’s request, which is currently on appeal before Germany’s Federal Court of Justice. The Higher Regional Court of Berlin underlined that CJEU caselaw does not affect the international legal system established through Germany’s ratification of the ICSID Convention, which is independent from national courts.

Conclusion

Despite the effort of the CJEU, the inadmissibility of intra-EU disputes in arbitration is still not well recognized by all European courts. Although the Paris Court of Appeal annulled two arbitral awards by relying on Achmea, the Higher Regional Court of Berlin refused to declare an ECT arbitration inadmissible on the same ground. The approach of the German court makes sense since EU law does not (and should not) have precedence over multilateral investment treaties.[12] Until a further legislative step on the matter is taken, admissibility of intra-EU matters before arbitral tribunals will remain highly disputable.

- The Judgment of the Court (Grand Chamber), Case C‑284/16, Slowakische Republik (Slovak Republic) v Achmea BV, Case C-284/16, ECLI:EU:C:2018:158, 06.03.2018, (Access date: 28.052022).

- Birengel, Tilbe: “Impact of the Achmea Judgment on Investment Arbitration”, Erdem & Erdem Newsletter, https://www.erdem-erdem.av.tr/en/insights/impact-of-the-achmea-judgment-on-investment-arbitration

- Vattenfall AB and others v. Federal Republic of Germany, ICSID Case No. ARB/12/12, the Decision on the Achmea issue, https://www.italaw.com/sites/default/files/case-documents/italaw9916.pdf, (Access date: 28.052022).

- UP (formerly Le Chèque Déjeuner) and C.D Holding Internationale v. Hungary, ICSID Case No. ARB/13/35, https://www.italaw.com/sites/default/files/case-documents/italaw10075.pdf, (Access date: 28.052022).

- Masdar Solar & Wind Cooperatief U.A. v. Kingdom of Spain, ICSID Case No. ARB/14/1, https://www.italaw.com/sites/default/files/case-documents/italaw9710.pdf. (Access date: 28.052022).

- Judgment of the Court (Grand Chamber) of 2 September 2021, Republic of Moldova v Komstroy LLC, a company the successor in law to the company Energoalians, C-741/19, ECLI:EU:C:2021:655, (Access date: 28.05.2022).

- Birengel, Tilbe: “Komstroy Decision: End of an Era for Intra-EU ECT Arbitration or Not?”, Erdem & Erdem Newsletter, September 2021, https://www.erdem-erdem.av.tr/en/insights/komstroy-decision-end-of-an-era-for-intra-eu-ect-arbitration-or-not

- Poland v. Strabag, Raifessen, Syrena Immobilien Annulment Action Paris Court of Appeal Decision no. 48 /2022, 19.04.2022, Strabag contre republique Pologne.pdf (lbr.cloud), (Access date: 28.05.2022).

- Poland v. Strabag, Raifessen, Syrena Immobilien Annulment Action Paris Court of Appeal Decision no. 49 /2022, 19.04.2022, Strabag contre republique Pologne.pdf (lbr.cloud), (Access date: 28.05.2022).

- Mainstream Renewable Power Ltd, International Mainstream Renewable Power Limited, Mainstream Renewable Power Group Finance Ltd, Horizont I Development GmbH, Horizont II Renewable GmbH, and Horizont III Power GmbH v. Federal Republic of Germany, ICSID Case No. ARB/21/26, Decision on Respondent’s Application Under ICSID Arbitration Rule 41(5), dated 18.01.2022, (Access date: 28.05.2022).

- Ibid, par. 126.

- Fisher, Toby: German Court Refuses to Block Intra-EU Claim, Global Arbitration Review, 26.05.2022, (Access date: 28.05.2022).

All rights of this article are reserved. This article may not be used, reproduced, copied, published, distributed, or otherwise disseminated without quotation or Erdem & Erdem Law Firm's written consent. Any content created without citing the resource or Erdem & Erdem Law Firm’s written consent is regularly tracked, and legal action will be taken in case of violation.

Other Contents

Emergency arbitration addresses the need for interim protection before the arbitral tribunal is constituted in institutional arbitrations. Arbitral institutions establish short timeframes to ensure parties can obtain interim relief quickly. For example, the International Chamber of Commerce (“ICC”) requires that the emergency...

International arbitration remains the preferred mechanism for resolving complex cross-border disputes. Yet despite its advantages—neutrality, enforceability, flexibility—arbitration is frequently criticized for being too slow, too expensive, and too procedurally heavy. Often, parties proceed through hearings and...

For arbitral awards rendered in international commercial arbitration to produce legal effects in foreign jurisdictions, they must be subjected to proceedings for “recognition” and “enforcement.” This process is governed by the New York Convention as well as by the provisions of the Law on Private International Law...

Arbitrability, the determination of whether a specific subject matter can be resolved through arbitration, constitutes a fundamental aspect of arbitration within the scope of international commercial dispute resolution. This concept draws a delicate balance between party autonomy—a fundamental principle of arbitration...

The recognition, enforcement, and annulment of foreign court and arbitral awards in Türkiye are processes in which public policy emerges as one of the most critical criteria for review, both in theory and in practice. The Court of Cassation decisions determine the direction of case law regarding the scope and...

As is well known, the action for annulment of objection is a special type of lawsuit regulated under Article 67 of the Turkish Execution and Bankruptcy Law No. 2004 (“EBL”). The primary objective of this action is to nullify a debtor’s objection to execution proceedings. Despite its procedural function of facilitating...

On 16 December 2024, the London Court of International Arbitration (“LCIA”) released its third batch of challenge decisions covering the period from 22 July 2017 to 31 December 2022. The LCIA has also issued a detailed commentary that identifies key legal themes and analytical trends, offering practitioners...

The International Chamber of Commerce (“ICC”) has published its report on the dispute resolution statistics for 2023 (“Report”) , shedding light on the evolving landscape of international arbitration...

Syndicated loans undoubtedly hold a significant position among global financing models. In 2023 alone, 3,655 syndicated loans were provided to companies in the US, with their total value reaching USD 2.4 trillion...

Preliminary attachment refers to the temporary seizure of a debtor's assets to secure a creditor's claim. While it serves as a vital instrument for safeguarding the rights of creditors, it is subject to specific and stringent conditions under Turkish law to prevent any potential misuse...

One of the most important reasons for parties to choose arbitration is the opportunity to freely choose their arbitrators. This freedom granted to the parties also distinguishes arbitration from proceedings before state courts, where the parties are deprived of the power to determine the judges who will conduct the...

The 6th Civil Chamber of the Court of Cassation ruled on October 12, 2022, that national courts have jurisdiction over objections to provisional measures in international arbitration disputes...

The declaration of intent to resolve disputes through arbitration is the fundamental constituent element of an arbitration agreement. To speak of a valid arbitration agreement, the parties' intention to arbitrate must emerge in a way that leaves no room for dispute...

In the wake of the evolving dynamics of commercial transactions, the Netherlands Arbitration Institute Foundation (NAI) announced new arbitration rules . 2024 NAI Arbitration Rules are in force as of 1 March 2024 and will be applicable on proceedings filed on or after this date...

With the global shift to online activities, domain names play a crucial role in identifying businesses. It is more common than ever for a domain name to be registered that is confusingly similar to a trademark or service mark...

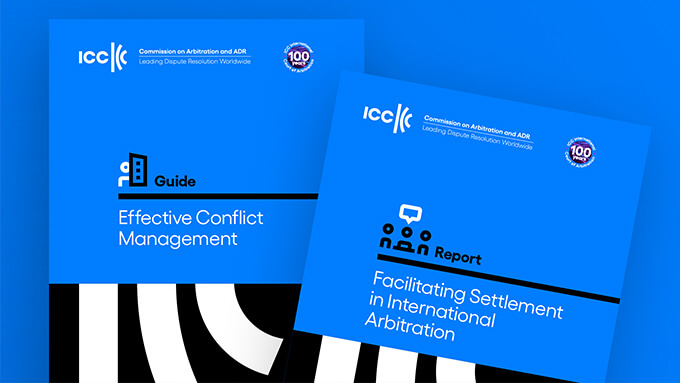

The ICC Commission on Arbitration and ADR (“Commission”) published a new guide and report with the aim to increase awareness on alternative dispute resolution (“ADR”) mechanisms to prevent disputes and strengthen the relationship between all stakeholders.The Guide on Effective Conflict Management...

Mergers and Acquisitions (“M&A”) are restructuring of companies or assets through various types of financial transactions, such as mergers, acquisitions, purchase of assets, or management acquisitions. This Newsletter article covers M&A disputes being solved before arbitral tribunals.

In the context of arbitration practice, the principle of revision au fond means that the courts can not examine the merits of a dispute when reviewing an arbitral award. This principle is most commonly encountered in set aside and enforcement proceedings. An arbitral award is evidence of the parties’ willingness...

Under Turkish law, parties may agree on the settlement of disputes that have arisen or may arise, regarding the rights that they can freely dispose of, by arbitration. However, disputes which are not subject to the will of parties, such as the disputes relating to in rem rights of immovables, bankruptcy law...

On 4 September 2020, a research project “Does a Right to a Physical Hearing Exist in International Arbitration?” was launched by an International Council for Commercial Arbitration (“ICCA”) taskforce. Due to the Covid-19 pandemic, many arbitration hearings were held online. Many institutional rules...

Dubai International Arbitration Center amended its Arbitration Rules on 25 February 2022. The 2022 Arbitration Rules were published on 2 March 2022 and came into effect on 21 March 2022. The Rules will be applied to arbitrations that are filed after 21 March 2022; unless parties agree otherwise...

Under Turkish law, the legal remedy that can be applied against arbitral awards is an annulment action. Law on International Arbitration No. 4686 (“IAL”) finds its application area in arbitration proceedings where Turkey is the place of arbitration...

It is well known that following a decision of the Court of Justice of the European Union, problems arose related to arbitration of intra-EU disputes, and particularly arbitration under the Energy Charter Treaty...

Arbitration in corporate law contains controversial elements in many respects, especially the issue of arbitrability. Even in legal systems where these disputes are considered to be arbitrable, uncertainties remain on whether an arbitration clause can be included in the articles of...

Arbitration has benifited from a great increase in the use of technology which has directly effected the conduct of proceedings. More particularly, with digitalization, the way that we conduct arbitration proceedings has been changed to reflect the current needs of parties, with an aim of increasing time...